Rule of 72

Here’s a handy rule of thumb for calculating compound interest:

If you want to know how many years it will take your money to double, if it grows at a yearly rate of r, just divide 72 by r.

For example, how long would it take for your money to double if it grew at a yearly rate of 5%? \(72/5 = 14.4\) years. And, sure enough, \(1.05^{14.4} = 2.01\)!

So let’s say you’re trying to figure out how much money you’ll have saved for retirement if you save now $100,000 and it grows at an annual rate of 5% for the next 30 years? It will double every 14.4 years, so in 28.8 years it will double twice, so it will be a little more than $400,000. How’d we do? \(100,000 * 1.05^{30} = 432,194\). Pretty good for something you can do in your head!

Probably obvious, but this trick can also convert between a “doubling time” and an interest rate. If I tell you that your money will double in 10 years, you know the interest rate is about \(72/10 = 7.2\%\). And, sure enough, \(1.072^{10} = 2.004\). Very close!

How does it work?

What’s the equation we’re trying to solve?

\[(1+r)^y = 2\]- r is the interest rate

- y is the doubling time (the number of years it takes to double)

- and 2 is because we want our money to double

We need to turn an exponent into multiplication/division, which usually means taking the log of both sides. Let’s try it:

\[\begin{align*} (1+r)^y &= 2 \\ ln \big( (1+r)^y \big) &= ln(2) \\ y \cdot ln(1+r) &= ln(2) \\ \end{align*}\]So far, everything we’ve done is exact. Now it’s time to make a few approximations:

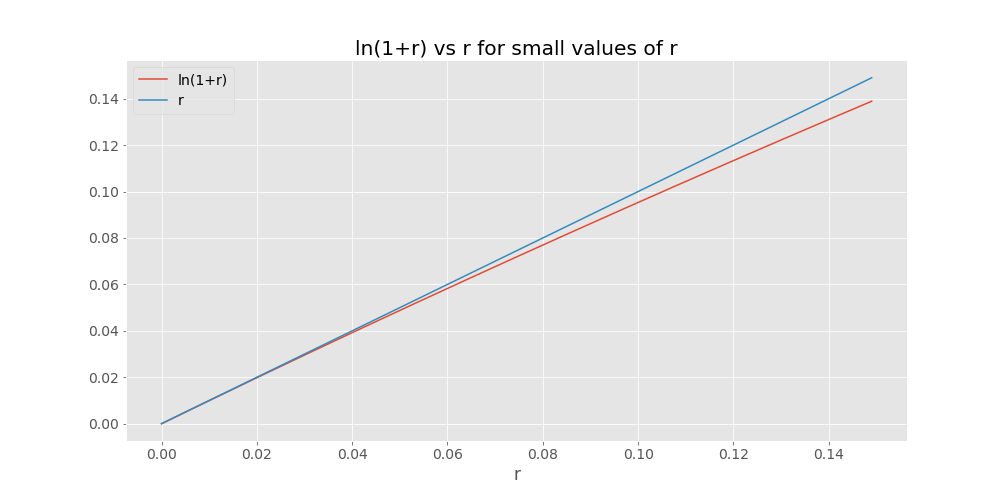

\[\begin{align*} ln(2) &\approx 0.693 \\ ln(1+r) &\approx r \tag{for small r} \\ \end{align*}\]The first one is trivial, you can just check it with a calculator. Why, though, is the second one true?

You can think about it this way. \(e^0 = 1\). And the derivative of \(e^x\) at 0 is also 1. So, if you zoom in really close around 0, it looks like a straight line with a y-intercept of 1 and a slope of 1. Which means, for small values of r, \(1+r \approx e^r\). And if we take the natural log of both sides, we get \(ln(1+r) \approx r\).

So, using what we have so far, we can say:

\[\begin{align*} y \cdot ln(1+r) &= ln(2) \\ y \cdot r &\approx 0.693 \\ y &\approx \frac{0.693}{r} \end{align*}\]This works just fine, especially for really small values of r. For example, how long would it take for your money to double at a 1% interest rate? 69.3 years right? \(1.01^{69.3} = 1.99\). Close!

So where does 72 come from?

Well, \(ln(1+r) \approx r\) gets to be a worse approximation as \(r\) gets large. In particular, \(r\) is an overestimate for \(ln(1+r)\).

So, when we divide by \(r\) in \(\frac{0.693}{r}\), we’re dividing by something that’s too large. For “normal” interest rate values - say, 8% - \(r\) is about 4% bigger than \(ln(1+r)\). So, to adjust for that fact, we can just make numerator 4% bigger as well. What’s \(0.693 * 1.04\)? 0.72!